China’s demand for foreign brands of cosmetics and beauty products has spawned a whole industry of professional buyers. Known in China under the name of “daigou”, they specialize in buying products from abroad to bring them into China without paying taxes.

While this cross-border gray market was estimated at 43 billion RMB ($ 6.3 billion) in 2016 before a government crackdown, times are changing and trends in the global beauty industry are shifting towards more modern consumption patterns. .

Some of the changes in demand for the beauty industry are being led by Gen Z women, or those born 1995-2010, now in their 20s, who are digital natives and grew up e-commerce. They represent a new type of consumer who is more open to foreign brands, but also appreciates local businesses, as evidenced by the meteoric rise of Guangzhou-based cosmetics giant Perfect Diary.

“The younger generation has totally different habits and a totally different decision-making process, not only for what they buy but also for what they like,” said Hugo Yu, founder of iDS BuyBuyBuy. KrASIE.

Yu launched iDS BuyBuyBuy after recognizing a gap in the cross-border e-commerce industry and a desire to get more information about the beauty industry.

Identify and capitalize on changing trends

Before launching his startup, Yu spent almost 10 years working for the famous fashion magazine Harper’s Bazaar China. From 2004 to 2015, she gained valuable experience during what she calls “the golden age of China’s luxury trade”. She also made valuable connections with representatives of foreign cosmetic brands like L’Oréal, Estée Lauder and others, during this time.

Doubting the future of print media, Yu began to hang out with friends in the tech industry and began to consider a potential entrepreneurial path in the e-commerce industry.

After a dinner in Shanghai with executives of the US-listed luxury shopping platform Farfetch, and conversations with Qi Chen, a friend and founder of the fashion-centric e-commerce platform Mougujie, Yu decided to also launch its digital platform, dedicated to the beauty and world of personal care. In 2017, she launched iDS BuyBuyBuy, with Chen as the company’s first angel investor.

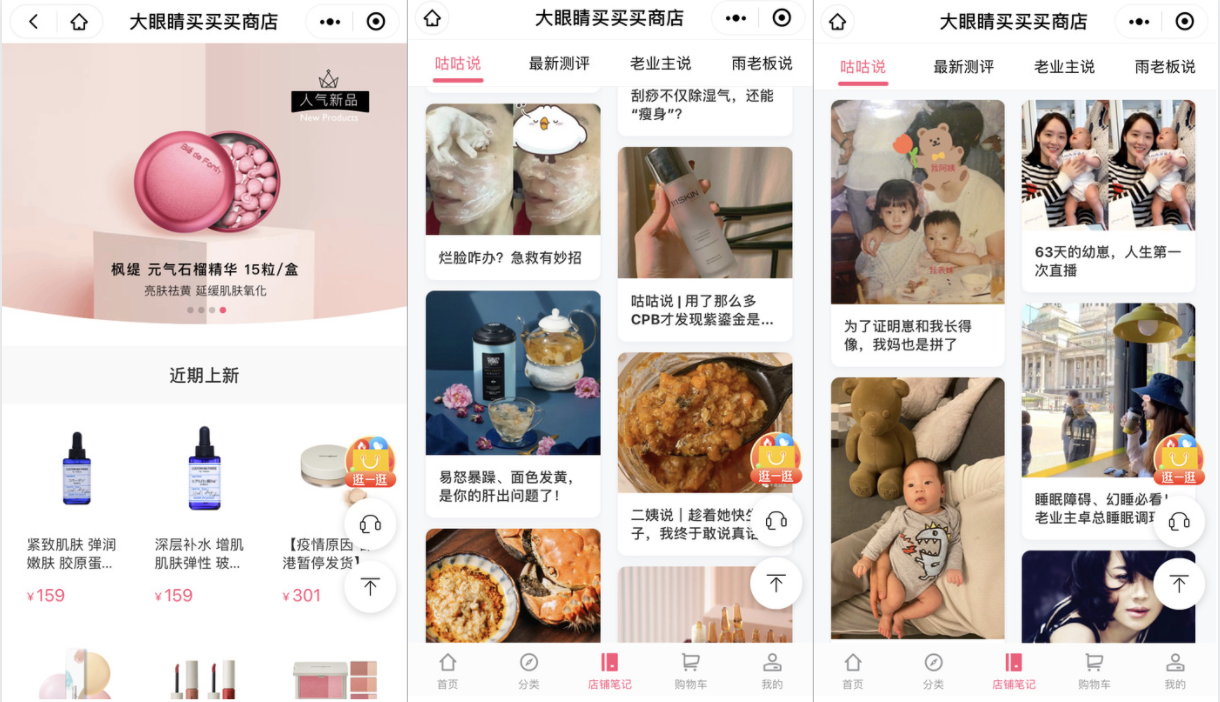

In its early days, the Beijing-based company worked on developing its own native app, but to no avail. The company only started to gain traction when it decided to leverage Functionality of Tencent’s WeChat mini program to develop its application in September 2017.

“People live in WeChat, they sleep in WeChat, it’s their social and family network,” Yu said.

While most apps attract users with a clear purpose, be it for entertainment or online shopping, WeChat users do not have a clear purpose when spending time in the office. application, according to Yu. As of the third quarter of 2020, the WeChat super application had over 1.2 billion monthly active users, according to data from Statista. The launch of a mini program on this platform allowed iDS BuyBuyBuy to reach a large group of social media oriented users.

As the platform grew, Yu leveraged its old relationships in the fashion and beauty world to partner with iDS BuyBuyBuy with more than 50 well-known international brands. Meanwhile, ambitious niche brands like MZ Skin, By Terry and Chantecaille were interested in capitalizing on a new digital sales channel that provided them with hyper-targeted marketing opportunities, Yu said.

Focus on content over sales

While the company’s main income comes from buying branded products and reselling them on its platform, Yu insists that iDS BuyBuyBuy does not prioritize sales and does not want to be labeled. as an e-commerce business.

It’s the content that sets iDS BuyBuyBuy apart, she says.

Many of the company’s 200 million Young users from all social channels use the platform to discover or learn more about new products, before making a final purchase on iDS BuyBuyBuy, or other platforms like Alibaba’s Tmall, Yu explained.

A team of nearly 30 content creators provide a space where product-related content can be trusted and original work can thrive, Yu said. In-depth consumer reviews of products, as well as discussions at within the community, give confidence to young Chinese buyers when comparing brands, helping them in the selection process.

With a community content engine as its foundation, the company has evolved into a platform where great brands can be presented to consumers through the use of organic content produced by Key Opinion Consumers (KOCs) and business leaders. key opinions (KOL). Many little-known brands, both Chinese and foreign, preferred to debut on iDS BuyBuyBuy before establishing official stores in other online marketplaces, Yu said.

“Alibaba platforms are not friendly to content creators, especially original content that appeals to the younger generation, in part due to the proliferation of deceptive content, such as when an authentic image accompanies a fraudulent product. “, she added.

The company has even become a brand incubator, providing investment capital as well as sales and marketing support to start-up founders. Traditional Chinese medicine wellness brand Yu Sum Tong is one of them.

Building and serving a community

“We want to be the reliable and credible friend who gives users the best solution for what they need,” Yu explained.

The company goes out of its way to humanize its users in its community, branding them as loyal customers as opposed to fans or subscribers. iDS BuyBuyBuy also has around 100,000 users as part of its VIP program, which provides highly engaged members with access to the company’s one-on-one consultation service that can provide advice on product and life-related topics.

“We want to be there and share wisdom with our community beyond products, like dealing with discomfort during pregnancy, or even a complicated relationship with a mother-in-law,” she said.

The company, which employs around 100 people and has already achieved profitability, according to Yu, earned $ 40 million in its Series B + funding round last November. Investors included Orchid Asia, Lightspeed China Partners and SIG-China. The fees found will be used to speed up operations.

Going forward, Yu believes his company is poised to take advantage of changing industry trends. She is also optimistic about the future of the Chinese cosmetics and beauty market.

“Right now, there is a historic opportunity in the market for local Chinese brands,” she said.

This article is part of KrASIA’s “Inside China’s Startups” series, where the authors of KrASIA interview the founders of technology companies in the country.